Behavioral finance – psychology in crypto investing

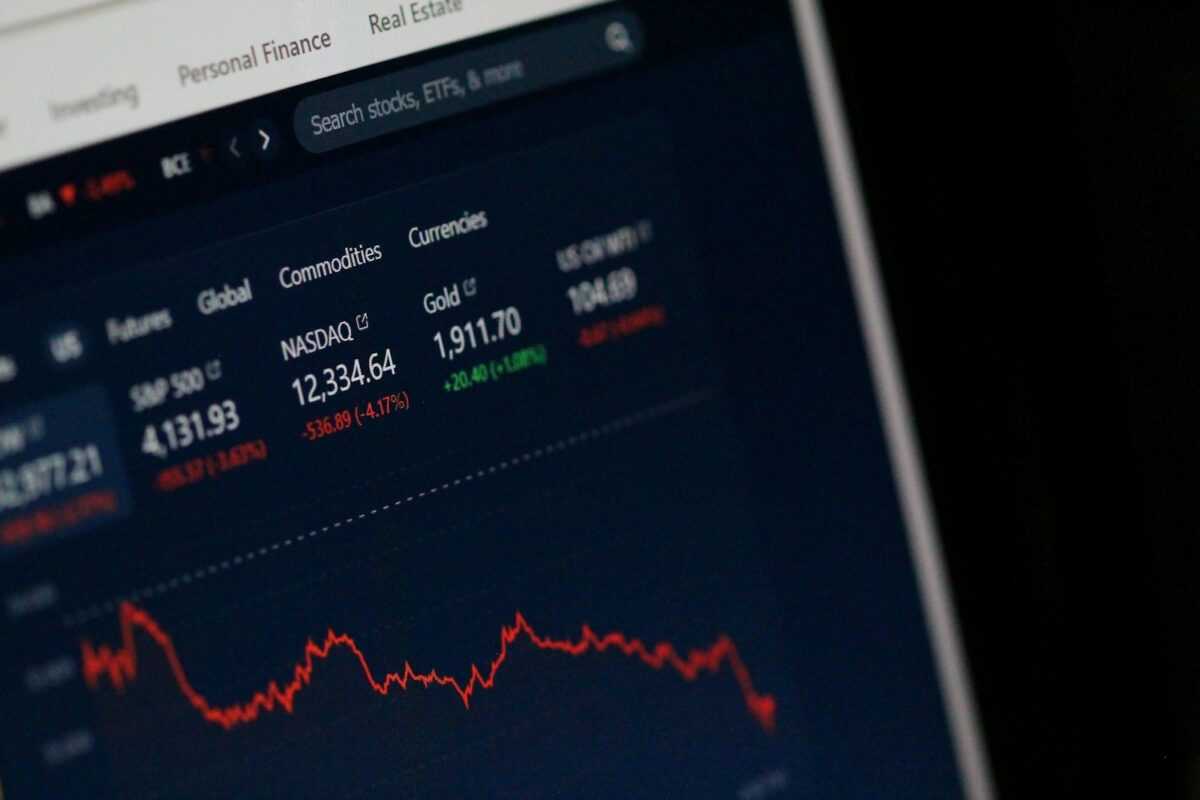

Recognizing emotional triggers is paramount for optimizing asset allocation within volatile markets. Human responses to rapid price swings frequently override rational evaluation, skewing judgment and amplifying risk exposure. Recent data reveals that over 65% of individual traders admit to impulsive actions driven by fear or greed, underscoring the necessity of mastering cognitive biases during portfolio … Read more