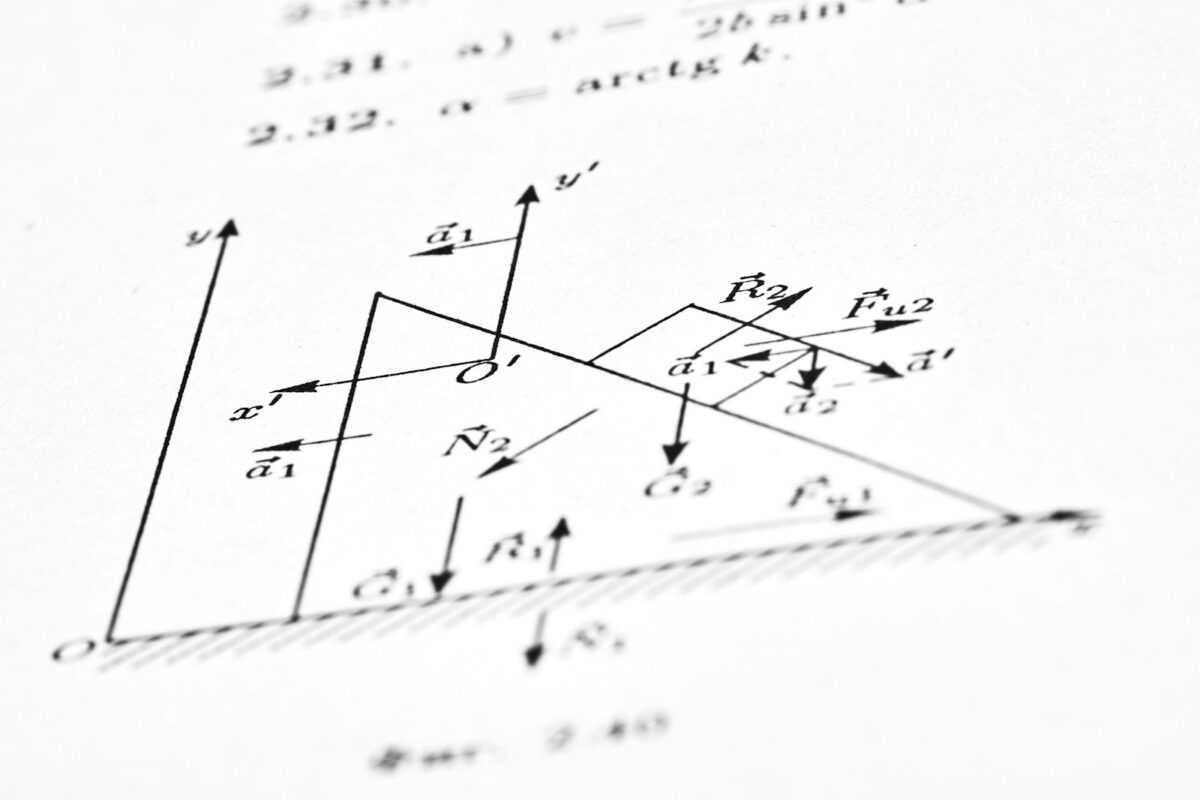

Asymmetric bets – limited downside unlimited upside

Prioritize strategies where potential loss is capped but the gain can far exceed initial investment. This approach optimizes reward relative to risk by confining maximum exposure while allowing profits to multiply without restriction. Structuring transactions with a confined negative impact yet expansive positive potential creates a favorable payoff profile that outperforms traditional symmetrical risk-reward setups. … Read more